Six Ibex 35 banks generated $20.85 billion in revenue in 2022, and the change sparked a debate about banking practices after what many citizens will change, since the loans and mortgages they continue being more expensive after the rises of types of European Central Bank (ECB).

Throw gasoline The government itself targets this sectorry announces new taxes. But how much money do banks earn in Spain?

Six Ibex 35 banks, Banco Santander, BBVA, Caixabank, Banco Sabadell, Bankinter and Unicaja Banco, added a record profit of 20,850 million euros in 2022.

The other side of the coin is that, at the same time, customers have converted their loans remain significantly more expensive, which caused big problems.

And the Government has not been immune to the debate after approving a new tax for the financial sector a few months ago that will tax the interest margin and the net commissions at 4.8%, considered “benefits of heaven.”

The executive's intention is raise about 1.5 billion dollars in two years, remembering that the interest and commissions received by bank branches outside Spain will not be deductible for tax purposes.

The latter is an important point, considering that about two-thirds of the profits of 20,850 million were generated by banks outside Spain.

If only take into account national interests, the figure is slightly lower, 7,549 million euros.

Account in Spain

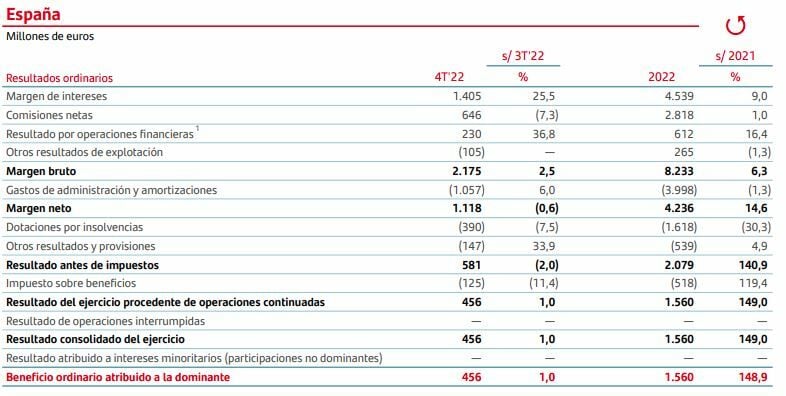

The most striking example is the Santander Bank, the largest Spanish bank in terms of assets, which closed 2022 with a profit of 9,605 million euros, a 18% more than the previous year.

In Spain, the figure was 1,560 million, below the contribution of Brazil (2,554 million) and the United States (1,784 million).

Other countries that contributed significantly to capital gains were United Kingdom (1,395 million) and Mexico (1,213 million).

Even so, the truth is that these 1,560 million represents a spectacular increase in 149% Over the previous year.

If we focus only in the fourth quarter, the group's share of current income increases 1% with respect to to the previous quarter, due to the strong growth in interest income, which absorbed the impact of the contribution to the Post Deposit Guarantee (262 million euros) and the pressure on administration expenses, where they begin to reflect high inflation rates, as explained by the Bank in its financial report.

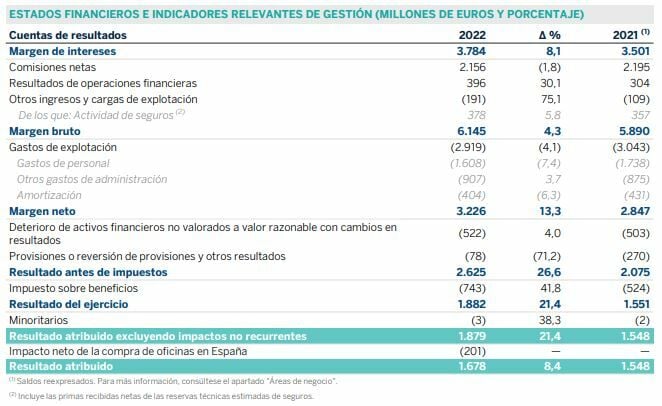

The other great bank with strong diversification of its activity is BBVA, which generated an attributed result of 6,420 million euros in 2022, which represents a growth of 38% compared to the previous year, and the best result in the history of the group.

However, most of this amount (4,182 million euros) corresponds to the Mexican activity.

Spain, for its part, generated an attributed profit of 1,678 million euros, a 8.4% higher than that obtained the previous year due to the dynamism of interest income and the increase in the result of financial operations (ROF), which along with some lower operating expenses and provisions set the trend year after year.

These results include a net impact of -201 million euros for the acquisitions of offices registered by MERLIN Properties in the second quarter of this year, excluding this effect The result will reach the 1,879 million euros, 21.4% more.

However, we must also take into account the net costs related to the restructuring process carried out by BBVA in 2021 in Spain, accounted for in the Corporate Center (-922 million).

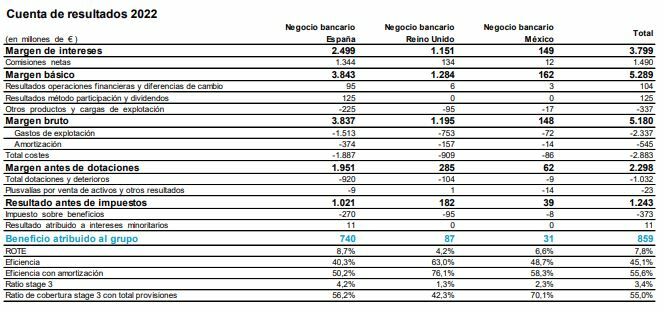

Sabadell Bank It has much less international exposure, earning 859 million euros at the end of fiscal year 2022.

This supposes a strong year-on-year growth, mainly due to the good evolution of legal receipts, as well as lower costs and lower provisions.

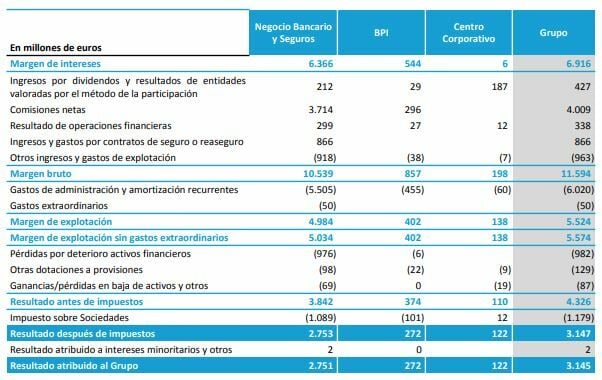

The bank with biggest profit in Spain is Caixabank, with a result of 2,751 million euros, a 41.5% upper to the pro forma result of 2021 (+1,944 million euros).

This figure represents the 87% of the 3,145 million revenues generated by the group through BPI with an important presence in Portugal.

Sim, Bankinter and Unicaja Banco are totally national. At first of the gerou um profit of 560 thousand of euros, 28 % as much as possible recover the results prior to the pandemic even without the Direct Line to Unicaja Bank, or profit was from €260 million.

How much will the new tax raise?

After the accounts offered by the six largest banks in the IBEX 35, it is unlikely that the Government's collection calculations will work without going into the fine print of the registry and the reports presented by the institution.

The net outflows of interest and commissions in Spain of Banco Santander, BBVA, Caixabank, Bank Sabadell, Bankinter and Unicaja Bank were less than 30,950 million euros, which translates into more than 1,480 million euros in taxes paid.

Legal entities have up tol February 20 to make the first payments, but they should keep in mind that they are likely to appeal, so the courts have the final say.